How Much Does Peoples Bank Debit Card Charge To Take Money Out In Europe

Hunt Bank is based in Manhattan and is i of the "Large Four" banks in the United States. Chase is office of JPMorgan Chase & Co., which operates in over 100 countries around the globe.¹ Hunt Bank has more than than 5,000 branches, as well as a network of around 16,000 ATMs.²

In this article, you'll read about what having a Chase debit menu will mean for yous as an international traveler.

Also, we'll help y'all think about your needs and what will best fit them, including a multi-currency account and debit card: the Wise account – effort it out to avoid foreign transaction fees.

Chase strange transaction fees

Is there a foreign transaction fee on Chase debit cards?

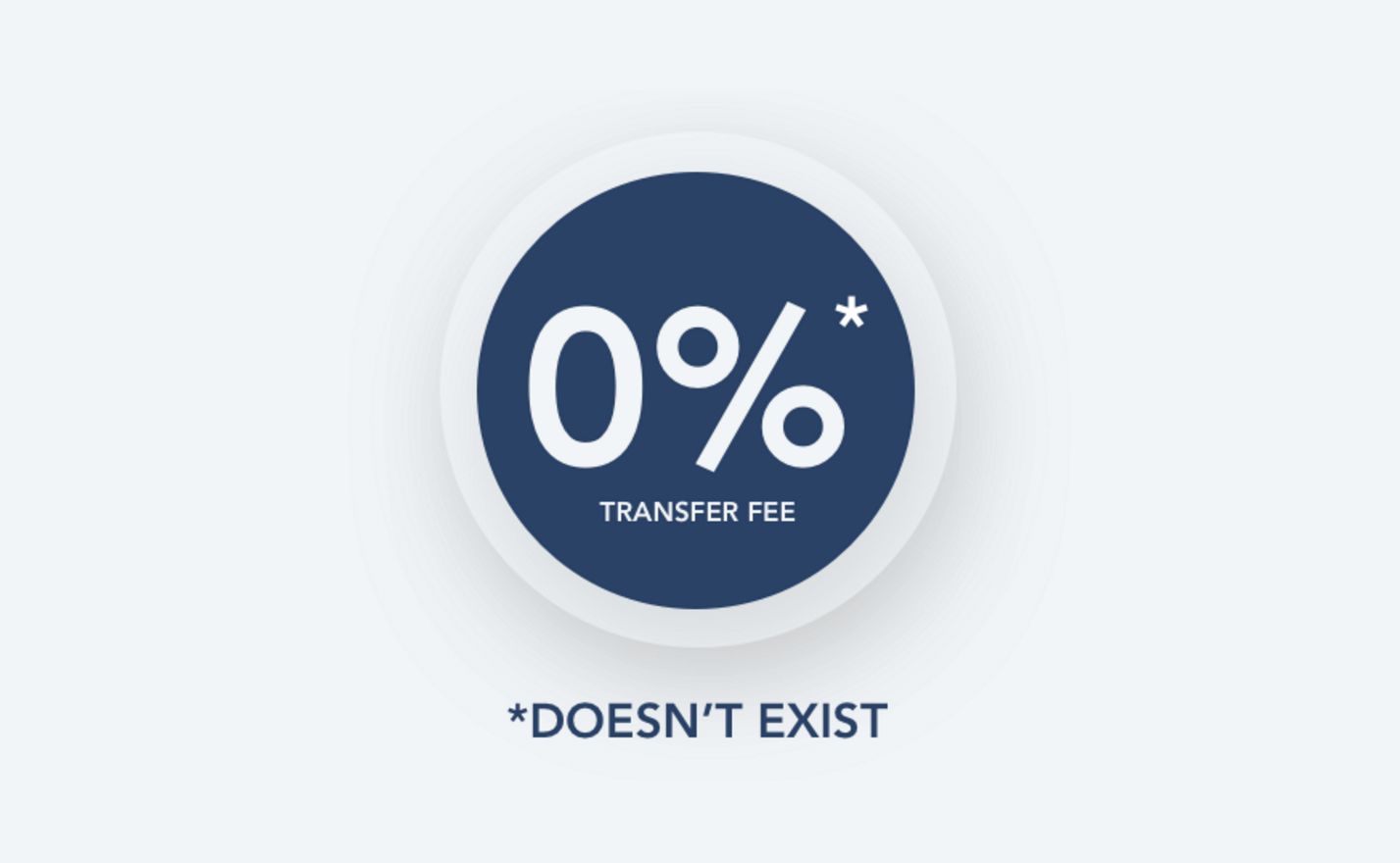

Yes - as you'd expect with most cards, there are fees to pay for some services with Hunt debit cards. These vary according to exactly which carte you pick, simply one that you'll see a lot is the foreign transaction fee.

The Hunt debit cards that they testify on their website charge a fee of iii% on every transaction you make in a currency that isn't Us dollars. That covers ATM withdrawals, cash transactions away from ATMs, and purchases you make with your card.

You'll get hit by this if you apply your card to get greenbacks from an overseas ATM or to make a purchase from a strange seller. The ATM situation is the most probable to affect y'all, since the fees can really pile upward if yous make a bunch of withdrawals.

| 💡 Practise you have a Chase Freedom Unlimited credit menu? We have a guide for you about foreign transaction fees here. |

|---|

Chase international ATM fees

Below are the fees for foreign ATM transactions with Hunt Total Checking Accounts.³

| Transaction blazon | Fees per transaction |

|---|---|

| Chase foreign ATM fee | $5 |

| International ATM inquiries and transfers | $two.50 |

| ATM operator fees | Depending on foreign ATM used |

How to avoid this pesky fee and foreign transaction fees?

One way could exist by signing up for the Wise debit card. You lot won't only escape the foreign transaction fee, just as well receive the mid-market rate on all conversions.

Another amazing feature is the free Wise account itself, where y'all're able to become your own details for the Uk, Eurozone, Australia and New Zealand, and more than to pay and become paid similar a local. Incredible convenience for both travelers and digital nomads.

Get a gratis Wise account

Hunt debit cards other fees and features

Strange transaction fees aren't the only things to think about when looking at debit cards from Chase. Nosotros couldn't find a large range of debit cards on the banking concern's website, only we've put together a summary of a few cards you lot may want to use while you're traveling, together with some of their central features and fees.

| Card proper name | Key features | Monthly fee | Other key fees and restrictions |

|---|---|---|---|

| Debit cards linked to the Hunt Total Checking account ⁵ | Optional Debit Carte Coverage for curt-term blessing of overdrawn purchases | $12 monthly, simply fee can exist waived if certain account conditions are met | $two.50 for overseas ATM balance inquiry/transfer, $5 for overseas ATM withdrawal |

| Hunt Disney Visa⁶ | A debit card offer discounts at many Disney locations and on merchandise | Depends on the business relationship fee, to which it'southward linked to | Not available with Chase High School Checking or Chase Admission Checking accounts |

| 💡 Check out our guide about Chase's travel cards here. |

|---|

Hunt debit international exchange rates

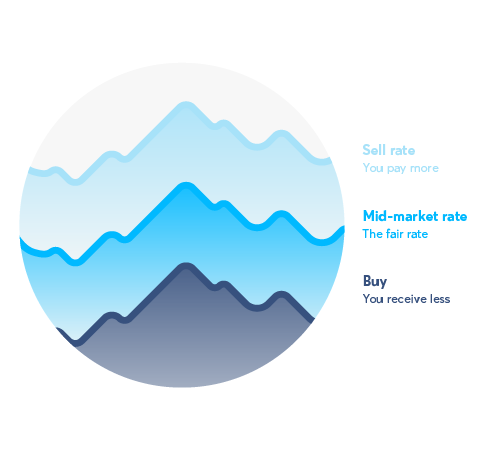

When yous're using your carte du jour abroad, either to purchase stuff or to withdraw money from an ATM, at that place are two main things that can make a divergence to the bargain you get. I is that your bill of fare provider can charge a fee upfront, simply the other is the commutation rate you're given. Y'all may not think well-nigh this at the time, but you'll notice the deviation when you see your statement after.

Luckily, you can go alee of the curve. The kickoff thing you'll need to know is the mid-marketplace charge per unit. This is what banks will use when they're doing transactions between themselves, and information technology's the number you'll meet if you use a site like Google to look up rates.

Unfortunately, information technology's often non the charge per unit you'll be offered abroad. That'southward because the ATM operator or card company will likely add a markup — information technology's rarely called a fee, but it has the same effect.

With a Wise account, you tin seamlessly transfer funds in over 50+ currencies using a single account. The only fee you lot'll pay is the one you lot'll run into clearly stated on the site. That'due south it.

And at Wise, we never hide extra fees and charges in the exchange charge per unit. We just utilise the exchange charge per unit – independently provided past Reuters. That means fair, cheap coin transfers, every time. If this sounds like what you've been waiting for, get alee and try it today.

Chase debit Dynamic Currency Conversion (DCC)

If you travel abroad and apply your debit menu, you'll want to make your coin go as far as possible, which means getting the best substitution charge per unit. The trouble is, Dynamic Currency Conversion (DCC) tin become in the way of that.

Here'southward the scoop. When yous utilize your menu to withdraw cash at an overseas ATM, or to make a purchase, you'll oft get the option to apply either the local currency or your ain. Y'all might call back using your ain would be the correct choice, and you'll ofttimes see DCC advertised as a great, convenient solution. But at that place'due south a pretty large catch.

Why? Considering when you cull DCC, the exchange rate used to convert betwixt the local currency and dollars is picked past the seller or ATM company. It often doesn't end at that place, as there can often be extra fees on tiptop. In the stop, you could pay a lot more than than you'd think from the Visa or Mastercard rate.

So, always choose to utilize the local currency. You could save a lot. If y'all desire to find out nearly DCC in more than item, you can check out our handy guide.

Chase's range of debit cards might be considered express by some, but they do have offers that may be very attractive for some users.

The Disney-branded carte offers discounts on Disney products that could accommodate people who make a lot of purchases, though information technology does have a monthly fee.

The Total Checking debit card will hitting also yous with a adequately hefty monthly fee, every bit well as charging you every time you use an ATM outside the Chase network.

Any your state of affairs, it'due south always a expert idea to terminate and retrieve virtually what unlike debit cards volition offer y'all, and comparing enough before you sign up. If y'all like the convenience of using a debit card while you travel outside the Us, pay special attending to the fees that are charged for foreign transactions or using overseas ATMs.

Sources

All sources last checked on 17 March 2022

This publication is provided for full general data purposes simply and is not intended to comprehend every aspect of the topics with which it deals. It is not intended to corporeality to communication on which you should rely. You must obtain professional or specialist communication before taking, or refraining from, whatsoever action on the basis of the content in this publication. The information in this publication does not institute legal, taxation or other professional communication from TransferWise Limited or its affiliates. Prior results do non guarantee a like outcome. We brand no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to engagement.

Source: https://wise.com/us/blog/chase-debit-card-foreign-transaction

Posted by: robertsonspegraidn.blogspot.com

0 Response to "How Much Does Peoples Bank Debit Card Charge To Take Money Out In Europe"

Post a Comment